We may earn money or products from the companies mentioned in this post.

Rice & Beans, Beans & Rice

You’re living paycheck to paycheck barely making enough to scrape by. You realize the importance of having an emergency fund but feel hopeless about the fact that you will ever be able to save for one. How exactly do you start saving for a true emergency when you feel like every single month is one? I remember that feeling all too well.

Like most people, a huge chunk of our income was going toward debt every month and when you’re not bringing in a whole ton of money debt is the very last thing you need.

When you’re struggling financially it’s tempting to use credit cards for the emergencies you can’t cover, but we need to be realistic, security doesn’t come from a credit card it comes from having the money saved when you truly need it without the worry of how you will ever pay it back.

On a low income saving for an emergency fund takes more than simply just “cutting back”. When you are living on a bare bone budget there usually isn’t an underlying shopping or Starbucks addiction (and if there is you should really stop now!) Although it may seem daunting it IS totally doable and when you finally start seeing progress it starts to feel extremely liberating.

Start Small Think BIG

In the beginning, it’s better not to have an audacious savings goal right out of the gate. Now, I’m not saying you shouldn’t think big but it is important not to overwhelm yourself right away. If we break up our saving goals into smaller pieces it helps to both keep us excited about our progress and also gives us the motivation to keep going. Two things we are definitely going to need! We started with $1,000. $1,000 is a good start but definitely isn’t the end. In today’s world most emergencies will run you more than $1,000 but when you are struggling to get by having something is better than nothing.

Sell, Sell, Sell

As Dave Ramsey says “Sell so much stuff that the kids think they’re next” Facebook groups, Craiglist, Ebay and garage sales are going to be your new best friend. There are even companies looking to purchase like Jancyn and MarketStat.

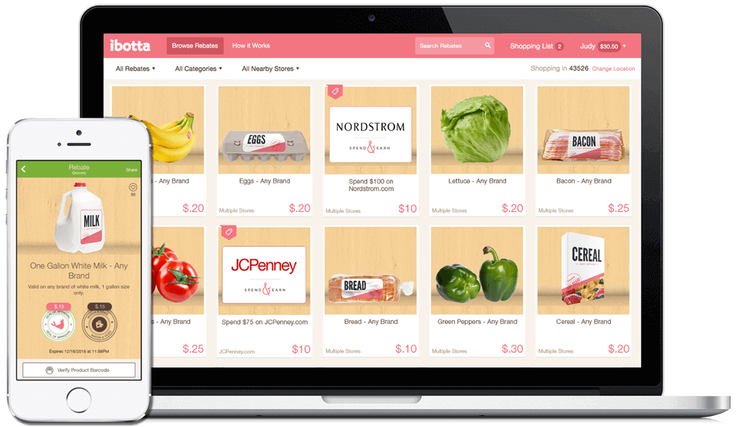

Get Cash Back On Things You Already Buy

Not everyone loves couponing and although I would highly suggest using coupons an easier way to get money back is to use apps that do all the money saving work for you. Ibotta is by far one of my fav’s. Not only do you get money back from buying real food that you would actually normally purchase but you don’t have to worry about holding up the checkout line with 10 million coupons. Simply save your receipt and redeem your offers when you get home. Another nice perk is when you sign up for the first time you receive a $10 bonus. You can also check out this post where I talk about other cash back apps that rock!

Lower Your Fixed Expenses

It’s time to comb through your monthly expenses and see what you can get a better deal on. Getting new quotes on car insurance may land you a better premium. Electricity/gas companies often have discounts for people on a lower income. Even trying to lower your grocery bill by eating simpler and cooking from scratch can help. It’s amazing how little changes and maybe even a phone call or two can give you some more wiggle room to put money into your emergency fund.

Here are a few more ideas to help lower fixed expenses

- Downgrading/changing cell phone plans/providers for better deals

- Giving up cable for other alternatives like Netflix, Hulu, Amazon etc.

- Staying home more/walking to places whenever possible to save on gas

- Downsizing home/renting to lower housing costs

Even with all these tips listed here, there is still so much more you can do. Resourcefulness is the key to saving money especially when you feel like you are barely above water. It’s important to celebrate all of your small victories. Every $1 you can save will bring you that much closer to your goal. Even if takes you longer than you expected or you run into unforeseen circumstances (like having to use some of that emergency fund you are trying to save for) having an emergency fund even a small one is better than having nothing at all. You will feel much more secure and way less stressed when emergencies do come your way.

Want to remember this? Post this now to your favorite Pinterest board!

Check Out These Related Posts:

40 Family Budget Categories For Your Brand New Budget

30 Totally Legit Ways To Save As A Stay At Home Mom

10 Things I Quit Buying To Save Money

How To Create A Meal Plan You Will Actually Stick To

How To Stop Spending Money On Things You Don’t Need