We may earn money or products from the companies mentioned in this post.

If you’re living on a tight budget you know how stressful it can be. Any emergency or unexpected expense could easily put you further into debt. But willingly staying in debt on a tight budget only keeps you broke longer so how exactly do you pay off your debt when you are barely making enough to get by?

Up until we paid off our debt 2 years ago my husband and I had lived on a low income for our entire marriage.

A year had never gone by that we weren’t pinching every penny wondering if things would ever change.

I was convinced the only way real people got out of debt was if they sold something expensive like their house or car. We didn’t own a home and the only car we had wasn’t worth much.

For years we just completely wrote it off as a possibility. Maybe someday in the far future when we made more money or the kids were older.

But then something crazy happened. I randomly stumbled upon the book The Total Money Makeover and everything changed. What once seemed impossible started to feel possible and boy was it ever.

Related: The 5 Best Easy To Read Financial Books For Beginners

Getting out of debt on a low income wasn’t easy in fact it probably was one of the hardest things we’ve ever done. But the financial freedom we received from it makes it totally worth sharing. Here are a few things we did to pay off $26,000 on a low income as a family of 5.

Save Extra Money With A Few Of My Favorites!

SAVE MONEY WITH A FEW OF MY FAV'S

Ibotta

With Ibotta, you can get cash back every time you shop online, in-store, or from your phone.

$10 bonus for new members!

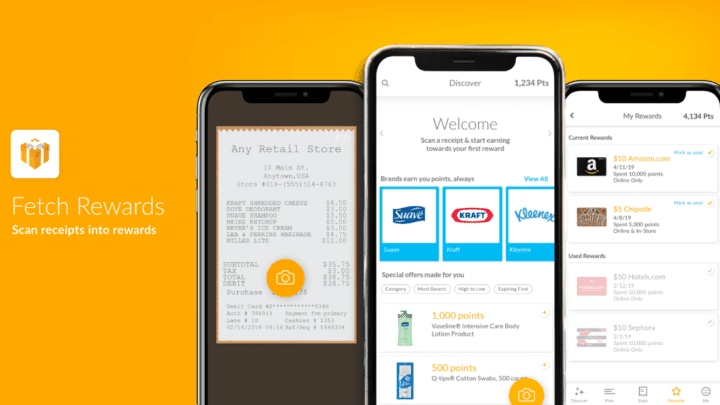

Fetch Rewards: The Easiest Way to Save

2,000 points ($2) for new sign ups. Check out my review HERE for more details.

Join $5 Meal Plan Today & Get a 2 Week Free Trial

For the price of a Starbucks you can make meal planning a WHOLE LOT easier.

Weekly meal plans sent straight to your inbox with grocery lists included.

Meal Planning Calendar and Grocery List App

A unique all in one meal planning tool.

Plan your meals, shop for ingredients & create grocery lists all in one spot.

The coolest thing? You can save the link to an online recipe and view everything from the recipe directly in the app.

How To Pay Off Debt On A Tight Budget

1. Get On A Written Budget

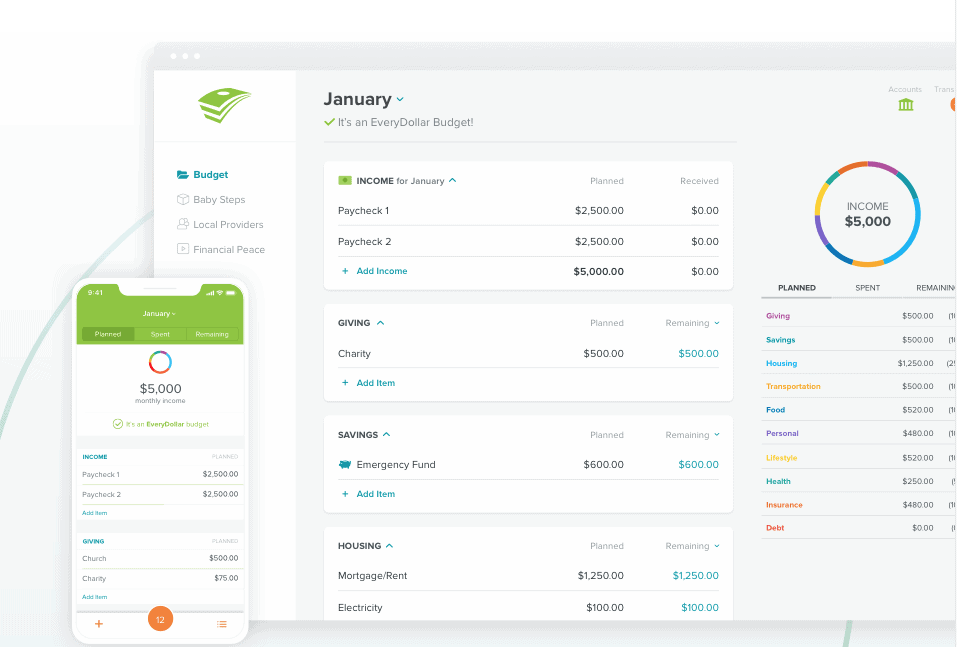

Getting on a written budget is an absolute must no matter how small your income is. The first step to tackling your debt once and for all is to see exactly where your money is going in the first place.

Getting on a written budget is important primarily for these 3 reasons:

- To see exactly how much money is coming in

- To know exactly how much your fixed expenses are (like rent) and how much you can comfortably afford for your variable ones (like groceries)

- To know exactly who you owe debt to, as well as the outstanding balances and minimum payments

I know when I first started our budget I thought it was pointless to be so meticulous over very little money coming in.

It surprised me to see how much we were spending in certain areas like groceries for instance. Waaaaaaay too much!

Writing your monthly budget doesn’t have to be a complicated process either. It can even be done on a simple piece of paper.

My favorite budgeting template to date is from Every dollar. It uses the zero based budgeting method which in my opinion is super helpful for people on a low income and was a total game changer for our family. This is the budgeting method that helped us to finally get out of the paycheck to paycheck cycle.

2. Nothing Left To Cut? Find Creative Ways To Reduce Spending

If you are living on a low income chances are you’re not out buying Starbucks drinks every day but that doesn’t mean there aren’t expenses you can cut even if it’s super minimal.

Spending less on groceries by $10-$20 a week can add up quickly and although $80 a month doesn’t seem like a lot to throw at a $3,000 credit card it really does make a huge difference.

Related:8 Quick Tips For Saving Money On Your Electric Bill – RENTERS EDITION

The first month where we made an additional payment towards our debt it was a whopping $50ish dollars but hey that $50 made more of a difference than never putting anything would have.

When we talk about reducing our spending we tend to think of obvious differences like stop eating out, don’t buy things you don’t need, or don’t go on vacation but there are lots of more subtle ways we can spend less that we usually don’t even think twice about.

Some ideas are becoming a one car family/drive less, using less air conditioning/heating, searching for new rates with car insurance, changing cell phone plan/provider.

3. Supplement Income With Quick Wins

When you’re on a low income any extra income you can earn makes a HUGE difference.

Sure, surveys are nice but they usually don’t pay well and the amount of time you spend doing them just isn’t worth the amount you actually receive. All around it can be more discouraging than it is encouraging.

When you are looking for a little boost to your income it’s best to spend time doing the things that give you the most bang for your buck so to speak.

If I can find a way to make money doing the things I already have to do it’s much easier to keep going because it doesn’t feel like extra work.

Using ibotta to get money back on my groceries, selling baby gear you are no longer using, furniture or electronics. Even broken electronics can be super valuable because they can be parted out.

Decluttering your house and selling things you no longer use. When I sold off my scrapbooking supplies I had items that I had purchased from discount stores that I didn’t realize were rare or popular and sold for 10x more than I originally paid.

4. Work Towards Increasing Income Long Term

While increasing income with quick wins is nice, eventually you’re going to run out of things to sell which is why it’s important to continue on working on increasing your income for the long term.

We live in a world where it’s becoming easier and easier to make money doing anything we really want to do. It’s crazy and wonderful to have all of these opportunities that didn’t exist 10+ years ago.

Whatever your passion may be try finding a way to make an income doing it. Think about how awesome it would be to have an extra $500-$1,000 a month. It could be such a blessing to your entire financial situation.

5. Challenge Yourself

When we were getting out of debt we found that no spend challenges and money saving challenges were a great way to build up funds to go towards debt.

During the summer months, we challenged ourselves to find as many free things as we could to avoid spending money on entertainment. Let’s just say we spent A LOT of time at the pool and park.

If you need some extra motivation printing off a debt free chart can really hold you accountable. It is not only a great way to visually see your progress but it also gets the kids involved too.

They absolutely loved being able to color in the chart every time we made a payment.

6. Find Community

Surrounding yourself around people who “get it” is super important for the long haul. Getting out of debt is tough and it’s so easy to get off track when you don’t have people in your life who understand what you are trying to do.

During our debt free journey, I found myself engaging with others on Instagram and Youtube. It’s nice to be able to get ideas from others, see progress from people who are getting out of debt just like you, and for motivation when the going gets tough.

Want to remember this? Save it to your favorite board on Pinterest!